In a weekend that rocked the financial world, the announcement of steep tariffs by President Trump sent shockwaves across both traditional and digital financial markets. The imposition of a 25% tariff on imports from Mexico and Canada, coupled with an additional 10% on Chinese goods, immediately triggered a sharp downturn in cryptocurrency prices, with Bitcoin (BTC) taking a significant hit. This policy move is not just a political maneuver but has now become a focal point for traders and investors globally, influencing deep shifts within the cryptocurrency landscape. As the markets recalibrated, Bitcoin plummeted from the $102,000 mark, reaching lows of $92,776 on major exchanges like Coinbase. The volatility reverberated throughout the crypto sector, leading to massive liquidations. According to Coinglass, a staggering $2.27 billion was wiped out as over-leveraged long positions unwound. However, the figures may underestimate the situation, as indicated by ByBit CEO Ben Zhou. Posting on X, Zhou disclosed that ByBit alone accounted for over $2 billion in liquidations, suggesting that the real number across exchanges might be closer to a daunting $8 to $10 billion. This discrepancy is attributed to limitations in API data feeds, potentially causing a significant underreporting of total liquidations. Zhou has committed to transparency, pledging that ByBit will enhance its data feed to ensure all liquidation figures are accurately reported. In a surprising turn of events, Trump’s swift tariff decision was temporarily eased following a “friendly” exchange with Mexican President Claudia Sheinbaum, resulting in a postponement and further diplomatic negotiations. This news provided a temporary reprieve, allowing Bitcoin to recover towards the $100,000 level. Despite this rebound, many altcoins continue to grapple with steep declines from their peak values, reflecting lingering uncertainty among investors. As these developments unfold, the long-term impact on both the crypto markets and broader economic conditions remains ambiguous. Traders and investors are urged to exercise caution, with eyes now locked on any further geopolitical maneuvers that might trigger additional volatility. Stay informed and ahead of market trends by subscribing to our updates. Follow us on our social media channels for real-time news and insights. Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry significant risk, and you should perform due diligence before making any financial decisions.

UMBRA AI

- Crypto

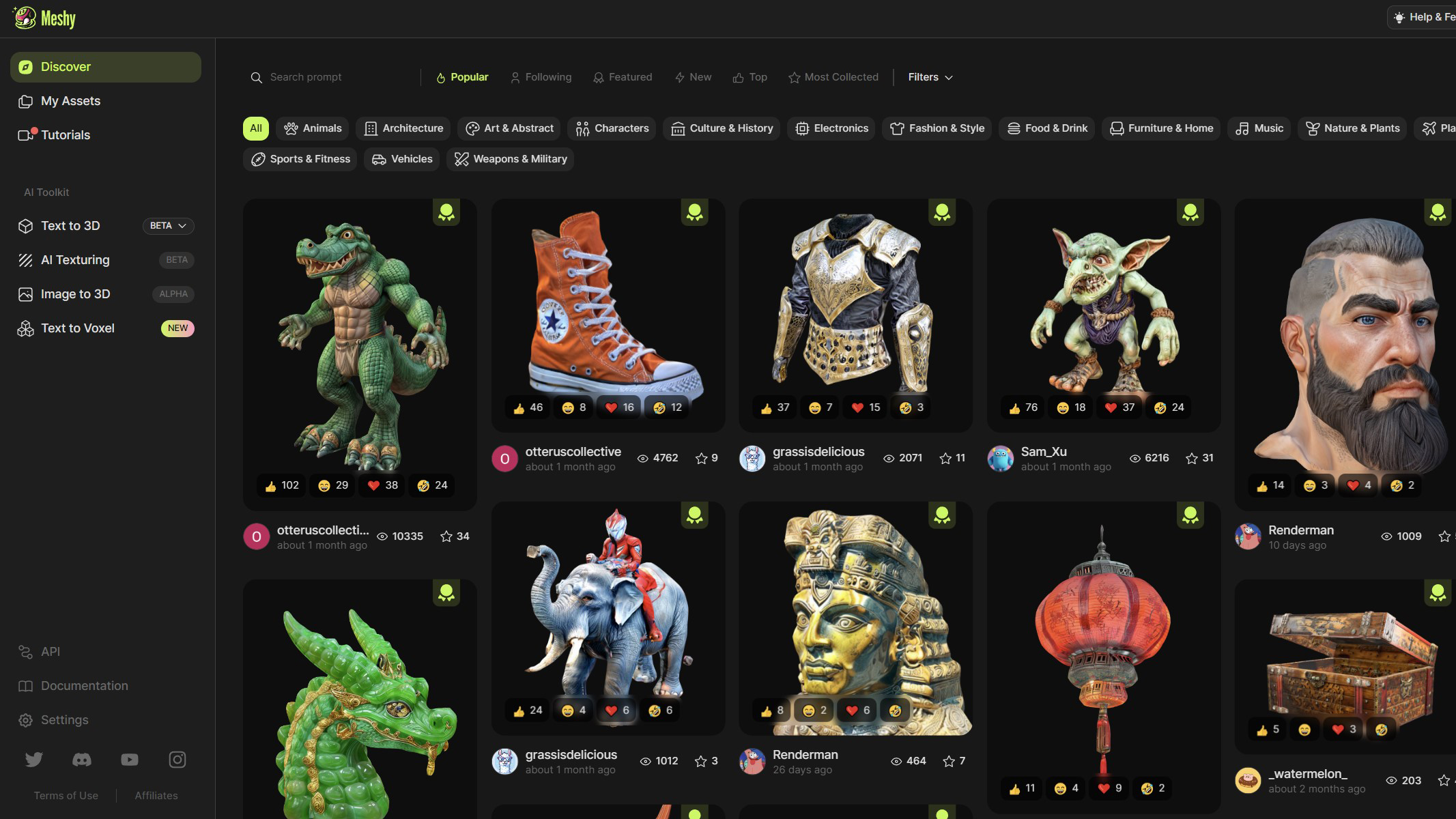

- Gaming

Gameplay Videos

GUIDES

NEWS

- Game Development

UE Tutorials

Articles

- AI Entertainment

© Copyright 2012 – 2020 | Zero Umbra Studios | Terms of Service | Privacy policy | Cookies