In 2024, several passive income sources offer potential for steady earnings with varying levels of initial investment and effort. Here’s a comprehensive look at some of the best options:

Investment-Based Passive Income

- Dividend Stocks and ETFs

- Dividend Stocks: Investing in dividend-paying stocks allows you to earn regular income from the company’s profits. These stocks pay out dividends, usually on a quarterly basis, providing a steady income stream. Long-term investment in a diverse portfolio of such stocks can yield substantial passive income (Investopedia) (Millennial Money).

- Dividend ETFs: Exchange-Traded Funds (ETFs) that focus on dividend-paying stocks offer a diversified way to invest in multiple companies. These funds aggregate stocks that pay dividends, providing regular income along with potential capital appreciation (Investopedia).

- Bonds

- Bonds are a safer investment compared to stocks, offering regular interest payments. They can be issued by corporations, municipalities, or governments. Bonds are less volatile and provide a predictable income, making them a good option for risk-averse investors (NerdWallet: Finance smarter).

- Real Estate Investment Trusts (REITs)

- REITs allow you to invest in real estate without having to manage properties directly. They own and operate income-generating real estate, such as apartments, offices, and shopping centers, and typically pay high dividends. Publicly traded REITs are easily accessible and can be purchased through online brokers (NerdWallet: Finance smarter).

Online and Digital Ventures

- Affiliate Marketing

- Affiliate marketing involves promoting products or services and earning a commission on sales made through your referral links. It’s a popular choice for bloggers, YouTubers, and social media influencers. High-earning potential comes from selecting the right products and effectively promoting them to a broad audience (Oberlo) (SoFi).

- Creating Online Courses

- If you have expertise in a particular field, creating and selling online courses can be highly profitable. Platforms like Teachable and Thinkific allow you to create courses and reach a global audience. Once set up, courses can generate income with minimal ongoing effort (Coursera) (Millennial Money).

- Self-Publishing Ebooks

- Platforms like Amazon Kindle Direct Publishing make it easy to publish and sell ebooks. Writing a book on a topic you’re passionate about can become a steady source of income as people continue to purchase your book over time (Coursera) (Millennial Money).

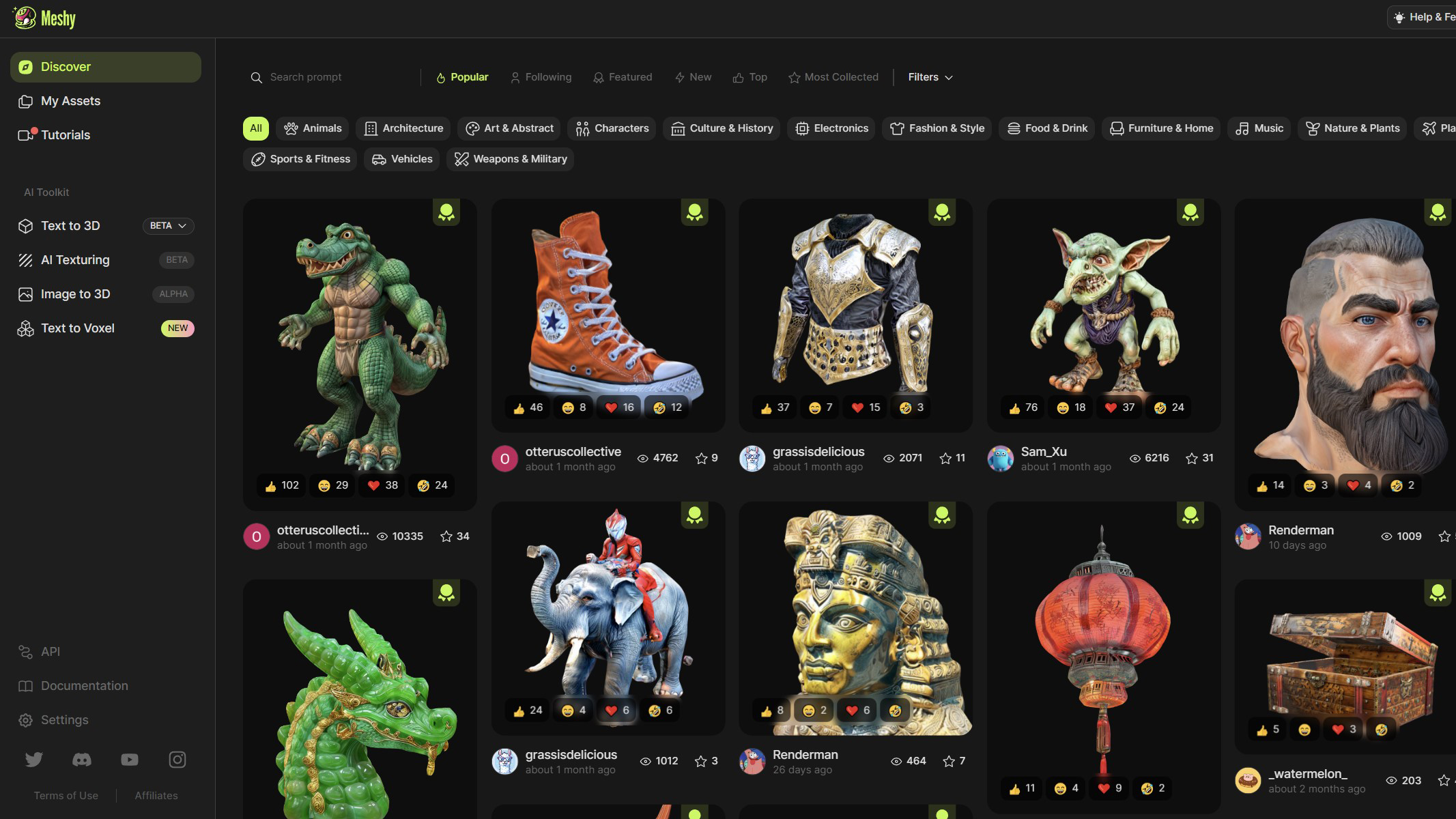

- Selling Digital Products

Real Estate and Physical Assets

- Rental Properties

- Owning rental properties can provide a significant income stream. While it requires a substantial initial investment and ongoing management, rental income can be quite lucrative. Alternatively, you can rent out part of your home on platforms like Airbnb to generate extra income (NerdWallet: Finance smarter) (Oberlo).

- Buying and Flipping Websites

- If you have web development skills, you can buy underperforming websites, improve them, and then sell them for a profit. Platforms like Flippa facilitate buying and selling websites, which can be a profitable venture if done right (Oberlo) (Millennial Money).

- Investing in Crowdfunded Real Estate

- Real estate crowdfunding platforms allow you to invest in real estate projects with a smaller amount of capital. These platforms pool funds from multiple investors to finance large projects, providing a share of the rental income or profits from property sales (Investopedia).

Miscellaneous

- Creating a YouTube Channel

- Starting a YouTube channel can be a lucrative passive income source. Once your channel meets the requirements for monetization, you can earn money through ads, sponsorships, and affiliate marketing. Consistently creating valuable content can build a loyal audience and generate ongoing revenue (Oberlo) (SoFi).

- High-Yield Savings Accounts and CDs

- High-yield savings accounts and certificates of deposit (CDs) offer low-risk income through interest payments. These financial products are ideal for risk-averse individuals seeking a safe place to grow their savings (NerdWallet: Finance smarter).

Each of these passive income sources requires different levels of investment, knowledge, and effort. Diversifying your passive income streams can help mitigate risk and provide a more stable financial future.