In a pivotal moment for Bitcoin, crypto strategist Ali Martinez is sounding the alarm for the digital currency’s investors. With BTC currently trading at $105,757, Martinez emphasizes to his 121,300 followers on the social media platform X a pressing need for Bitcoin to secure its position above a critical threshold to avert a significant downturn.

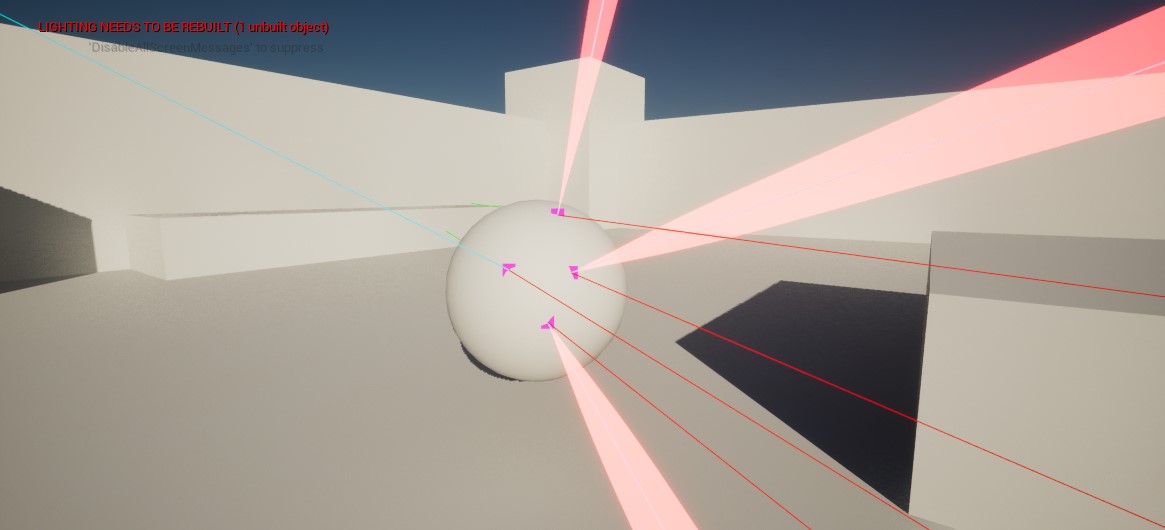

According to Martinez, Bitcoin must stabilize above the $91,700 support level. A failure to do so could trigger a daunting 30% decline, driving the asset’s value down to $74,000. This assertion is underscored by a trifecta of concerning indicators: rising selling pressure, a drying up of new capital, and dwindling network activity, all contributing to the precarious situation.

The strategist highlights the Market Value to Realized Value (MVRV) ratio as a crucial tool in identifying key support levels. The MVRV ratio, which compares a crypto asset’s market capitalization to its realized capitalization, indicates overselling when it dips below zero, suggesting that investors are enduring losses on their BTC holdings.

However, despite these foreboding signals, Martinez also leaves room for optimism. He suggests that the cycle peak might still be ahead. Drawing from historical cycle analyses and price patterns using the 200-day Simple Moving Average (SMA), he projects a potential bullish scenario where Bitcoin could rally by over 74% from its current standing. For BTC to achieve this, it would need to eclipse 2.4 times its 200-day SMA, which is presently set at $184,600.

Adding to the bullish outlook, Martinez points to the Mayer Multiple as another tool suggesting further upside potential for Bitcoin. This indicator, which evaluates the gap between Bitcoin’s current price and the 200-day SMA, echoes the possibility of a market top approaching $182,000.

As Bitcoin enthusiasts keep a close eye on these pivotal metrics, the coming days will determine whether support holds or if the market is poised for a deeper correction. Significantly, investors are urged to tread cautiously, keeping abreast of the evolving technical signals in this dynamic crypto landscape. While the charts reveal possibilities of both a correction and an upswing, the resilience of the $91,700 support will play a crucial role in Bitcoin’s immediate future.

Remember to stay informed and make prudent investment decisions, as the cryptocurrency market remains both thrilling and unpredictable.