In the dynamic world of cryptocurrencies, every seasoned investor and enthusiast strives to identify potential upward trends. A recent deep dive by renowned on-chain analytics firm Glassnode has unveiled compelling insights suggesting that Bitcoin (BTC) may have significant room for future growth. Delving into historical on-chain metrics, the firm uncovers fascinating parallels with past bull runs, pointing towards potential future price escalations. Central to Glassnode’s analysis is the Realized Cap, a metric that chronicles the price movement of each Bitcoin—essentially gauging the profitability of holders. According to Glassnode’s reports shared on the social media platform X, Bitcoin’s Realized Cap has displayed a notable 2.1x growth from its 2022 low. Comparatively, this figure remains below the peak 5.7x expansion witnessed in previous cycles, suggesting that the typical euphoric phase of a Bitcoin bull run has not yet fully unfolded. The insights don’t stop there. Glassnode correlates Bitcoin’s current cycle with its legendary 2015-2018 bull run, emphasizing the dominance of spot market investors. Despite the cryptocurrency’s enlarged market cap, Bitcoin has exhibited resilient demand characterized by ETF inflows and its strategic positioning as a macro asset, resulting in setbacks seldom surpassing -25%. Further analysis by Glassnode anticipates a potential “second euphoric phase” wherein surging demand historically accelerates price action. Yet, while explosive 100x rallies like those in 2015 remain improbable at Bitcoin’s current scale, burgeoning demand could issue in a promising expansion. At the time of writing, Bitcoin is trading at $101,807, experiencing a modest decline of over 3.5% in the last 24 hours. Despite this temporary dip, the long-term prospects unveiled by Glassnode ignite optimism for the continued ascent of the leading crypto asset by market cap. For those keen on staying abreast of these groundbreaking insights and market shifts, timely updates and expert analyses await through The Daily Hodl’s dedicated platforms. **Stay Ahead in the Crypto Curve:** – Subscribe for timely email alerts and real-time updates – Engage with us on social media via X, Facebook, and Telegram – Explore deeper insights with The Daily Hodl Mix **Disclaimer:** The information presented is not financial advice. Investors should conduct thorough research before entering high-risk investments in cryptocurrencies. The Daily Hodl assumes no responsibility for individual trading decisions.

UMBRA AI

- Crypto

- Gaming

NEWS

- Game Development

UE Tutorials

UE Blueprints

Articles

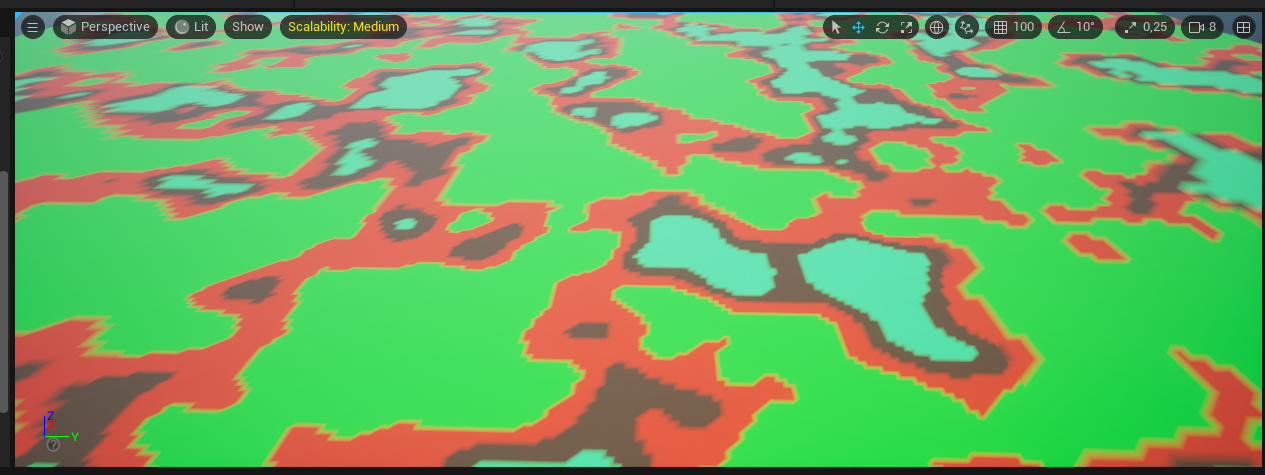

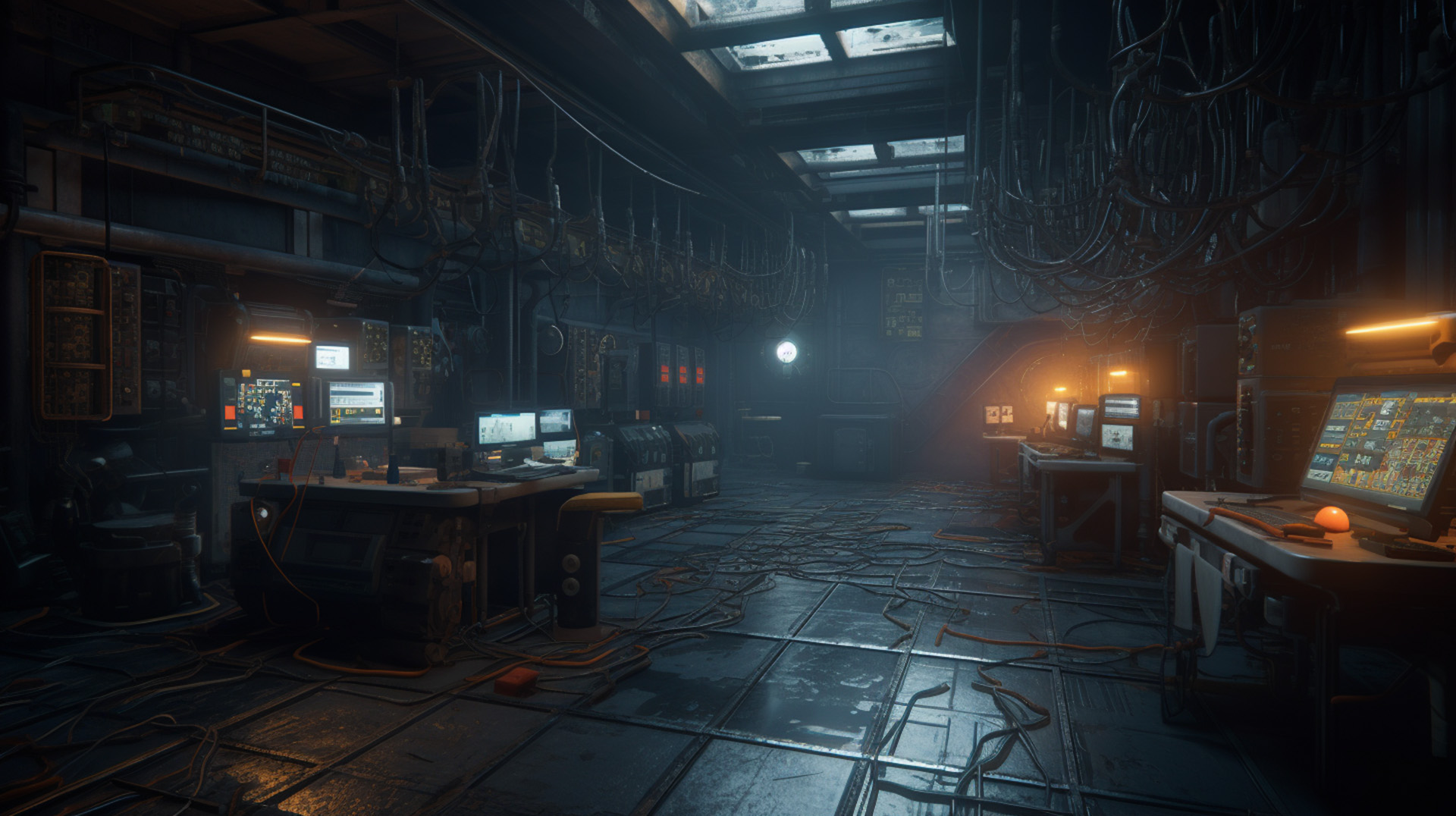

Game Content, Game Development

Game Content, Game Development, Unreal Engine, Unreal Marketplace

Blueprints, Game Development, Level Design, Plugins, Tools, Unreal Engine

Dev AI Tools, Featured, Featured - Game Dev, Game Development, Plugins, Tools, Unreal Engine

Game Content, Game Development

Featured, Featured - Game Dev, Game Dev News, Game Development, Unreal Engine

- AI Entertainment

© Copyright 2012 – 2020 | Zero Umbra Studios | Terms of Service | Privacy policy | Cookies

![0dang-54090763.jpeg safe_pos, score_9, score_8_up, score_7_up, (age up:1.0) BREAK 1girl , (blonde hair, messy bun, wispy bangs), (medium saggy breasts), freckles, cute face, [wrinkles, dimples],(realistic skin:1.3)∙(detailed skin:1.3)∙(skin texture:1.3)∙(perfect skin:1.3). leaning back, in water ,in hotspring, rocks,naked, reflection in water. (looking at viewer), [coy smile]. portrait , breast focus, side view, (closeup:1.2), dappled lighting. (bokeh, shallow depth of field). (cinematic lighting:1.3), (chromatic aberration), (4K image quality:1.3), (sharp detail:1.3), (highly realistic:1.3), (dim warm cinematic lighting:1.3)](https://umbra.ai/wp-content/uploads/2025/01/0dang-54090763.jpeg)