In the ever-evolving world of cryptocurrency, traders constantly seek insights to navigate potential market shifts. Recently, renowned crypto strategist Ali Martinez shared intriguing end-of-cycle price predictions for Bitcoin (BTC) and Ethereum (ETH), leveraging historical precedents as a guide. His analysis has garnered attention among his followers on the social media platform X. Martinez has turned to the Mayer Multiple—a technical tool that evaluates the price ratio between Bitcoin’s current valuation and its 200-day moving average. This tool has proven accurate in assessing whether Bitcoin is overbought or oversold. In past bull markets, when Bitcoin has traded above the Mayer Multiple’s 2.4 level, it’s signified an impending market top. Currently, this critical threshold for Bitcoin hovers around $182,000, indicating substantial growth potential from its present value of $98,772. Turning to Ethereum, Martinez employs the market value to realized value (MVRV) pricing band. This on-chain metric gauges asset valuation based on unrealized profits or losses. Historically, when Ethereum crosses the 3.2 MVRV Pricing Band, it suggests a heightened risk of profit-taking, potentially marking a cycle peak. Presently, the 3.2 threshold for Ethereum stands at $6,770, with Ethereum’s price at $3,072, suggesting ample room for potential growth. While these analyses indicate promising upward trends, traders are cautioned to remain vigilant. Historic patterns, while enlightening, are not definitive guarantees of future outcomes. Individuals are advised to conduct thorough research and exercise caution when making investment decisions in the volatile crypto landscape. Stay informed and follow Ali Martinez on X for real-time updates and insights.

UMBRA AI

- Crypto

- Gaming

Gameplay Videos

GUIDES

NEWS

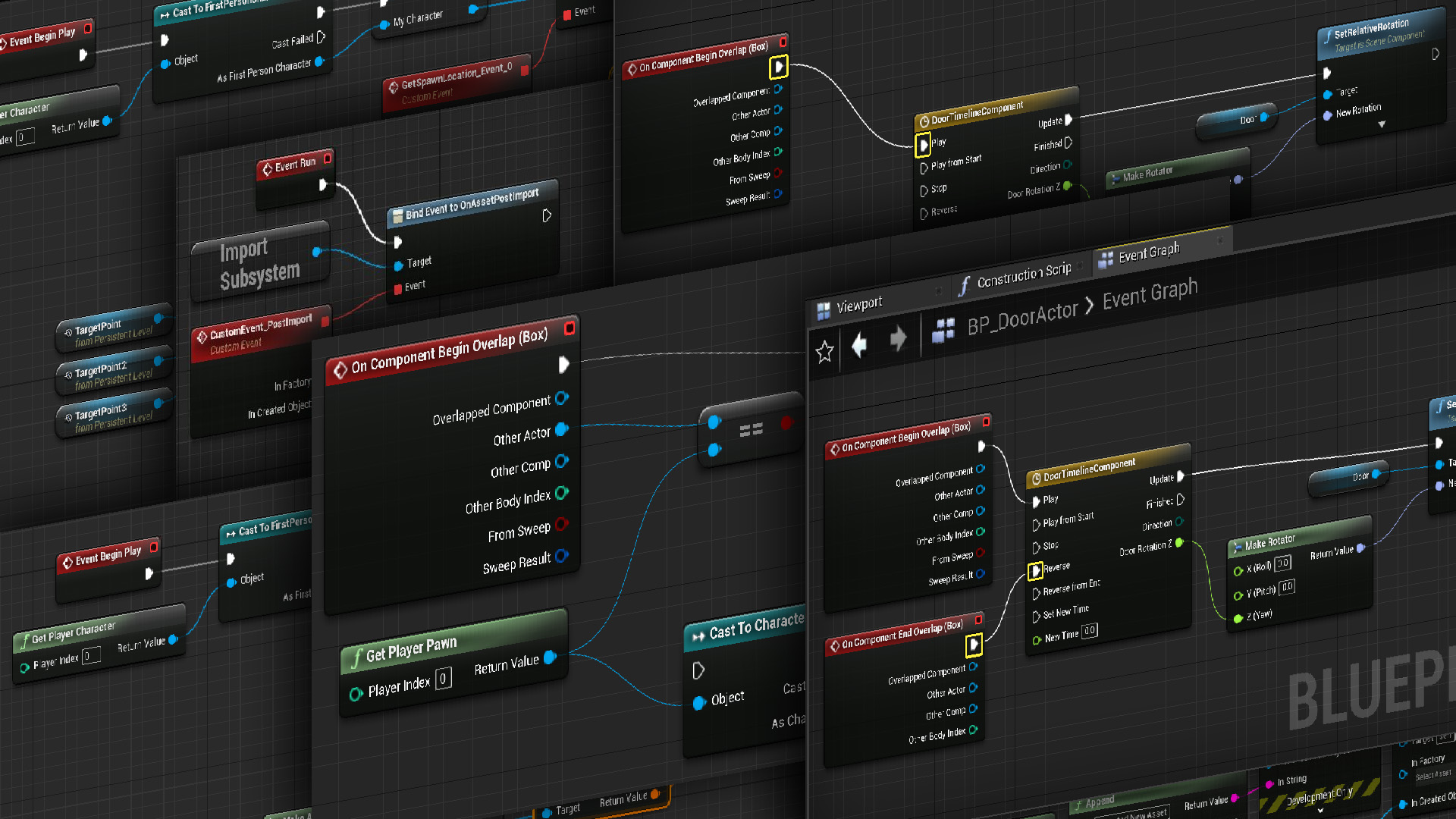

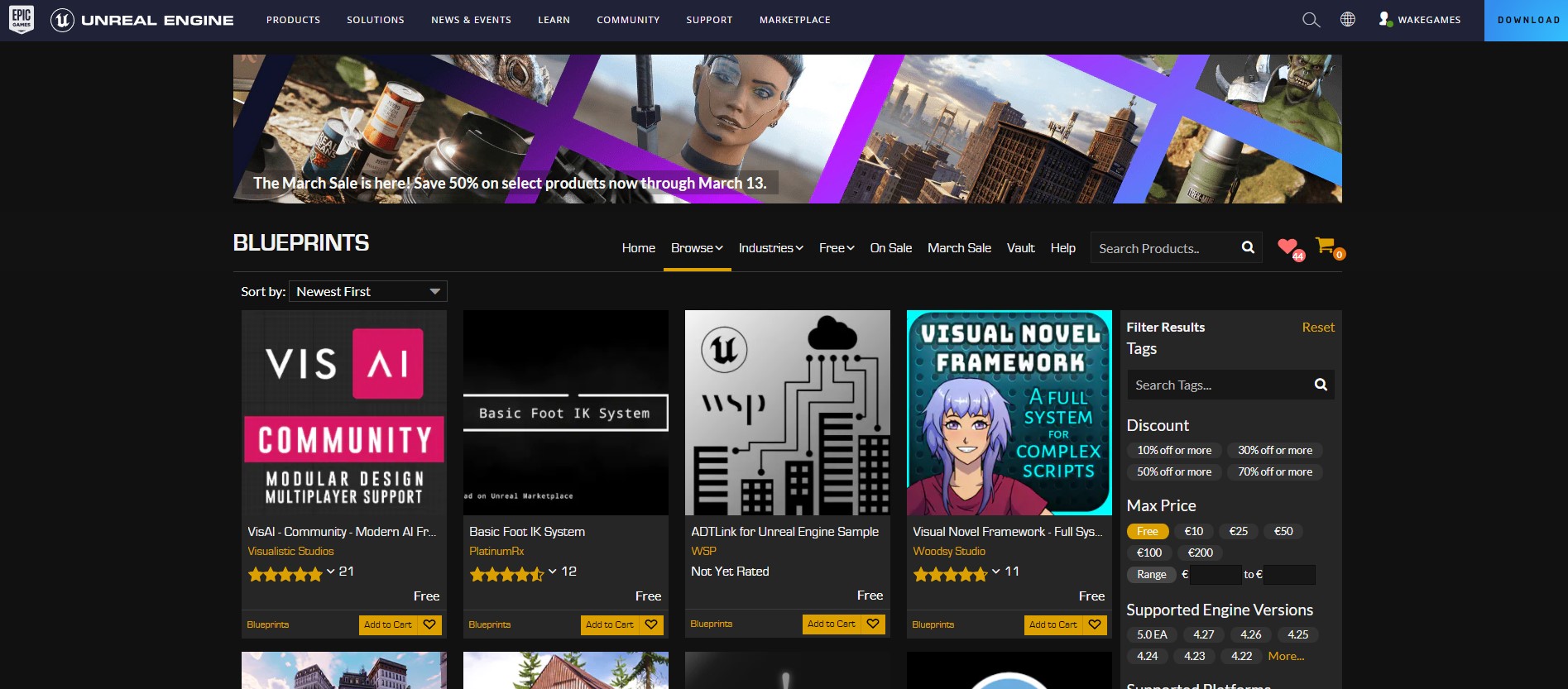

- Game Development

UE Tutorials

UE Blueprints

Articles

- AI Entertainment

© Copyright 2012 – 2020 | Zero Umbra Studios | Terms of Service | Privacy policy | Cookies